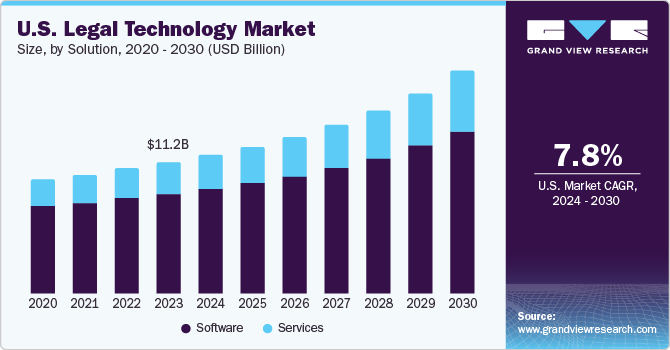

The U.S. legal technology market size was estimated at USD 11.24 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. The legal technology, or legal tech, refers to the technology and software solutions that streamline legal processes and services to enhance the experience of law practices. Therefore, legal professionals and firms use various tools and platforms to help with different aspects of their work, such as managing cases, automating documents, finding electronic evidence, analyzing contracts, conducting legal research, and managing compliance. As a result, the market is witnessing a surge in demand for legal tools that help law firms and legal departments operate more efficiently and cost-effectively.

The increasing investment in technologies aimed at automating and optimizing legal procedures to enhance the productivity and profitability of law firms is expected to drive significant growth in the legal technology market in the upcoming years. By leveraging cutting-edge technology solutions, law firms can streamline operations, reduce manual workloads, and improve overall efficiency. This shift towards automation saves time and allows legal professionals to focus on more strategic and value-added tasks, ultimately leading to increased profitability.

Furthermore, artificial intelligence-powered (AI) tools are revolutionizing the legal sector by offering natural language processing (NLP), predictive analytics, and document review automation capabilities. These AI applications analyze vast amounts of legal data quickly and accurately, helping lawyers extract valuable insights, make informed decisions, and provide more personalized services to their clients. For instance, in March 2023, Casetext, Inc. announced CoCounsel, an AI legal assistant powered by Open AI, aiming to change law practice. It offers skills to handle routine and sophisticated legal tasks, freeing up lawyers' time to focus on higher-value work. CoCounsel was developed with access to reliable information, rigorous testing, an intensive beta program, and the utmost data privacy and security measures. It aims to increase access to justice by making legal services more affordable and valuable.

The COVID-19 pandemic positively impacted the legal technology market, accelerating existing trends and driving increased adoption of technology solutions within the legal sector. One of the most notable impacts of the pandemic on the legal technology market was the rapid shift towards remote work and virtual collaboration. With law firms and legal departments forced to operate remotely due to lockdowns and social distancing measures, there has been a growing reliance on technology to facilitate communication, collaboration, and workflow management.

The industry concentration in the legal technology sector is relatively moderate, with a mix of established players and emerging startups competing to offer innovative solutions to law firms, corporate legal departments, and legal service providers. While some larger companies dominate certain segments of the market, there is also room for smaller players to introduce niche products and services that cater to specific needs within the legal industry.

The market growth stage is medium, and the pace is accelerating. The U.S. legal technology market is characterized by a high degree of innovation driven by advancements in artificial intelligence, machine learning, blockchain, and data analytics. Blockchain, with its secure and transparent ledger system, has the potential to transform how legal agreements are drafted, verified, and executed. By leveraging blockchain technology, law firms can ensure the integrity and authenticity of legal documents, streamline contract management processes, and enhance security and trust in transactions. The decentralized nature of blockchain also offers opportunities for smart contracts, which can automate and enforce contractual agreements without the need for intermediaries.

Technology companies are continuously developing new solutions to address the evolving needs of legal professionals, such as contract analytics, e-discovery tools, virtual courtrooms, and compliance management platforms. The rapid pace of innovation in legal technology is reshaping traditional legal practices, enhancing efficiency, and enabling legal professionals to deliver more value-added services to their clients.

Regulations significantly impact the legal technology market, as legal professionals must navigate complex regulatory frameworks related to data privacy and cybersecurity. Additionally, technology solutions in the legal sector must adhere to strict regulatory requirements to ensure data protection, confidentiality, and ethical use of technology tools. Compliance with regulations such as HIPAA and CCPA is crucial for legal tech companies to gain the trust of customers and maintain credibility in the market.

The software segment led the market with a revenue share of 75.7% in 2023. The increasing trend toward digital transformation and the widespread adoption of remote work practices are playing a pivotal role in driving the demand for software solutions in the legal technology market that cater to virtual collaboration, communication, and document sharing. As law firms and legal departments transition to remote work setups, there is a growing need for technology tools that enable legal professionals to collaborate effectively, communicate seamlessly, and share documents securely from various locations. Virtual collaboration tools have become essential for legal teams to work together remotely, ensuring that they collaborate on cases, projects, and tasks in real-time, regardless of physical distance. These tools facilitate video conferencing, screen sharing, instant messaging, and virtual meeting capabilities, allowing legal professionals to stay connected, brainstorm ideas, and make decisions collectively.

The services segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing demand for specialized expertise and support in implementing and utilizing technology solutions within the legal industry. As law firms and legal departments seek to adopt and integrate technology tools into their operations, they require services such as consulting, training, implementation, customization, and ongoing support to maximize the benefits of these solutions.

The contract lifecycle management (CLM) segment held the largest revenue share in 2023 owing to the increasing complexity and volume of contracts that organizations need to manage effectively. As businesses engage in growing contracts with customers, suppliers, partners, and other stakeholders, there is a heightened demand for CLM solutions that streamline the contract management process, improve visibility, and ensure compliance with contractual obligations. Moreover, the focus on risk mitigation and compliance management is driving the adoption of CLM solutions in the legal industry.

The analytics segment is expected to witness significant growth over the forecast period owing to the increasing volume and complexity of data that legal professionals need to manage and analyze effectively. As the legal sector generates vast amounts of data from various sources, such as case files, contracts, emails, and regulatory documents, there is a growing demand for analytics solutions that can process, interpret, and extract valuable insights from this data to support decision-making and strategic planning.

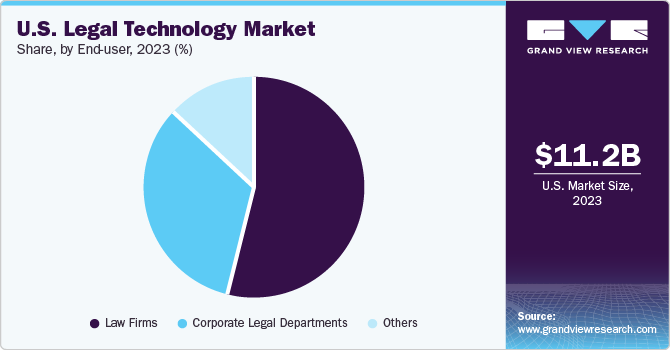

The law firms segment led the market with the largest revenue share in 2023. This can be attributed to the rising competition in a rapidly evolving industry landscape. As technology continues to advance and disrupt traditional legal practices, law firms are adopting digital transformation, adopting innovative solutions, and differentiating themselves from competitors. Technology tools such as practice management software, document automation platforms, and client relationship management systems enable law firms to enhance their service offerings by delivering value-added services efficiently.

The corporate legal departments segment is expected to grow at a significant CAGR over the forecast period. The rising focus on data security, privacy, and information governance is promoting the adoption of technology solutions that enable corporate legal departments to manage sensitive data securely and ensure data protection compliance. Data security breaches, privacy regulations, and cybersecurity threats pose significant challenges for corporate legal departments, prompting them to invest in solutions that offer encryption, access controls, data loss prevention, and secure collaboration features. By implementing data security technologies, corporate legal departments safeguard confidential information, prevent data breaches, and maintain trust and credibility with stakeholders.

Some of the key players operating in the market include Icertis, Inc., Filevine Inc., and DocuSign, Inc., Casetext Inc., and Knovos, LLC.

Report Attribute

Details

Market size value in 2023

USD 11.24 billion

Revenue forecast in 2030

USD 19.02 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation