- a. An Individual who was born in the US or is a US citizen or a US resident (including green card holder) or has a US address or US mailing address or US ‘in care of’ or ‘hold mail’ as a sole address.

- b. A US incorporated entity as described above.

Where is the Supplementary KYC, FATCA, CRS form available?

You can fill this form On line and physically((offline) . You don’t have to do both. Forms are also available with the mutual fund house or Registrar and transfer agent(R&T) such as CAMS/KARVY branch counters or can be downloaded from their websites.

- Online:R&T agents like CAMS and KARVY offer facility of filling up an online form. PAN needs to be submitted to generate form and OTP is sent to registered email ID and mobile number.It will update details in all the fund houses they manage. But for other fund houses you have to contact them separately.

- Physical submission or Offline: The said form, duly signed by the investor, along with necessary documents, may be submitted at any AMC branch or investor service centre.

What will happen If you do not fill the FATCA, Supplementary KYC form?

If you do meet this compliance requirement then fresh investments (SIP or Lump sum) will not be accepted from 1st Jan, 2016. You can only redeem your existing mutual fund units.

To lower the reporting burden, few top and large mutual fund houses like HDFC, ICICI, Birla, Reliance etc., have stopped accepting fresh investments from US residents and NRIs based in US. NRIs based out of other countries (other than US/Canada) can invest in all mutual fund schemes.

Any financial institution failing to comply will have to pay a 30 per cent penalty on all its US revenues, including dividend, interest, fees and sales.If you are an Indian base in the US and trying to hide the information from the Indian government then under the new Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, persons having unaccounted overseas assets were given an opportunity to come clean by declaring their assets till September 30 2015 and paying tax and penalty of 60 per cent. Those who will fail to declare their unaccounted overseas wealth during the voluntary compliance period will now have to pay tax and penalty of 120 per cent and face jail term which could extend up to 10 years.

What Information needs to be provided as part of FATCA?

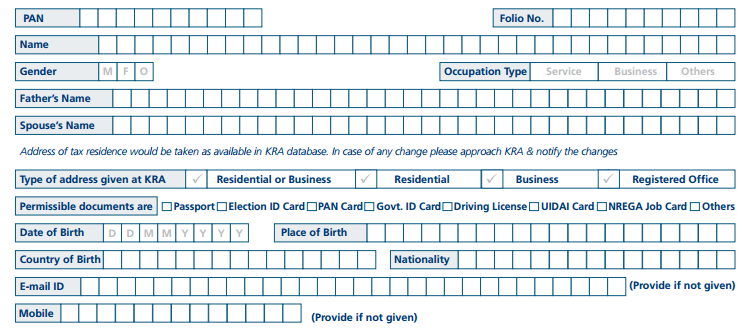

The following information is mandated as part of the FATCA requirements are given below.

- Country of Birth/Incorporation; Place of Birth/Incorporation

- Address Type [Residential or Business, Registered Office] for the KYC registered address

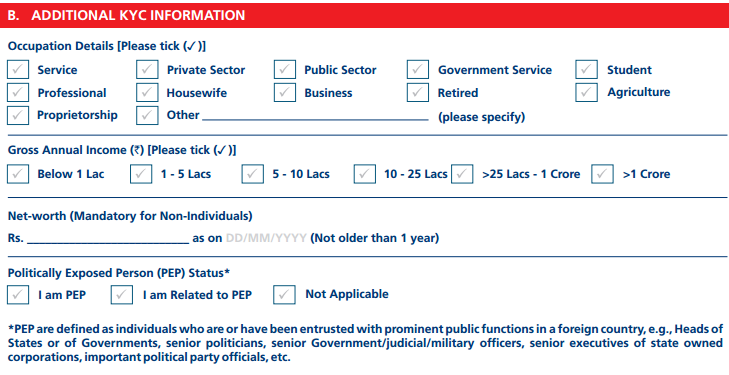

- Occupation; Applicant Income Slab

- Net Worth details

- Information about PEP [Politically Exposed Person & its relatives]. Politically Exposed Persons or (PEPs) are individuals who are or have been entrusted with prominent public functions in a foreign country, for example Heads of State or of government, senior politicians, senior government, judicial or military officials, senior executives of state owned corporations, important political party officials. Business relationships with family members or close associates of PEPs involve reputational risks similar to those with PEPs themselves. The definition is not intended to cover middle ranking or more junior individuals in the foregoing categories

- Information on specific Corporate services [applicable for Non-Individuals]

- Information about Ultimate Beneficiary Owner(s)/Controlling Person(s) [applicable for select category of Non-Individuals]

KYC Information required as of FATCA

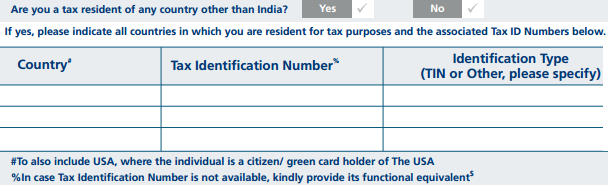

If the tax residency of the investor is other than India, then investors have to provide following additional information for all countries in which they are resident for tax purposes:

- Country of Tax Residency [also includes the US, where the individual is a citizen/green card holder of the US]

- Tax Identification Number [If not available, its functional equivalent to be provided]

- Identification Type [TIN or Other, to be specified)]

Tax resident Information for FATCA

Supplementary or Additional KYC Required

Additional KYC Information required

What documents have to be provided along with the Form?

Documents If PAN has not been provided, permissible documents include passport, election ID card, Aadhaar card, driving license, NREGA or a government ID card. In case taxpayer identification document is not available, an explanation needs to be attached.

Table of Contents

How to submit FATCA Declaration form online?

Click on link given below to visit the additional KYC & FATCA page of various mutual funds. You need to provide information to CAMS once for all funds it services, Karvy for all the funds it services. For example if you invested in HDFC Equity Fund, HDFC Balanced Fund, ICICI Prudential Blue Chip, Reliance Gold Fund, Franklin Templeton Short Term Fund then through CAMS you can provide details to HDFC Fund for HDFC Equity Fund, HDFC Balanced Fund, ICICI Mutual Fund for ICICI Prudential Blue Chip. Through Karvy you can update your details to Reliance Mutual Fund and through Frankling Templeton Investments to Franklin Mutual Fund.

- CAMS

- Karvy Mutual Fund Services

- Franklin Templeton Investments

- Sundaram BNP Paribas Fund Services

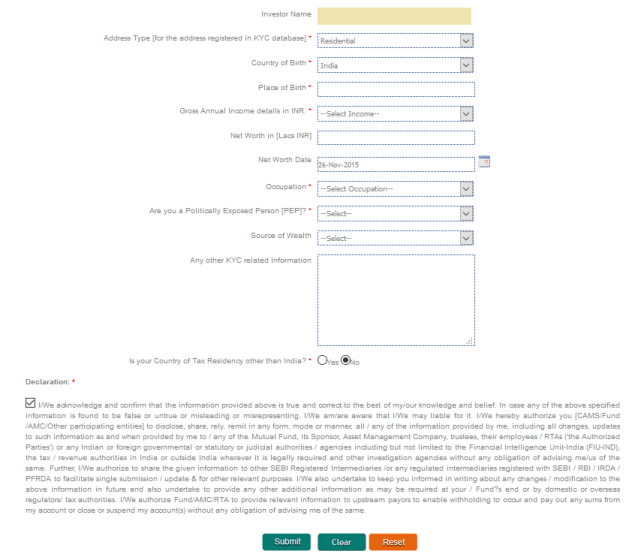

Filling FATCA Details Online at CAMS

If you have invested in mutual fund schemes serviced by CAMS such as Birla Sun Life Mutual Fund,DSP BlackRock Mutual Fund, HDFC Mutual Fund, HSBC Mutual Fund,ICICI Prudential Mutual Fund, IDFC Mutual Fund, IIFL Mutual Fund,JP Morgan Mutual Fund,Kotak Mutual Fund,L&T Mutual Fund,PPFAS Mutual Fund,SBI Mutual Fund,Shriram Mutual Fund,Tata Mutual Fund, Union KBC Mutual Fund

- Visit CAMSonline.

- Select AMC name, provide your PAN, Bank Account and Date of Birth details. You will receive OTP (One Time Password) on the registered mobile number.

Filling FATCA Details for CAMS

- For field Country of Tax Residency other than India(at bottom in the image below) select Noif you are resident of India. If your selection is ‘YES’, you have to provide other details

Filling FATCA Details about tax residency at CAMS

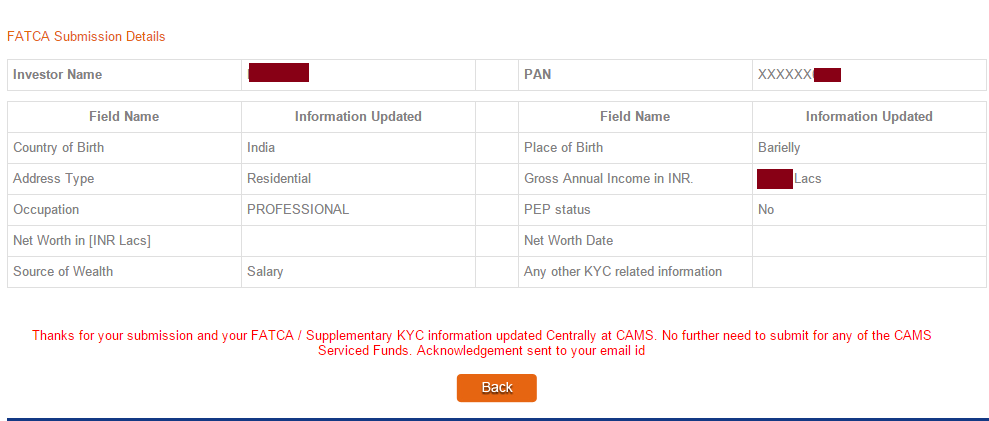

After submission at CAMS you get the submission details as shown in image below. Click on image to enlarge. It mentions clearly that you need to submit FATCA details about the fund CAMS services only once. Acknowledgement is sent to email id.

After Submission of FATCA details at CAMS

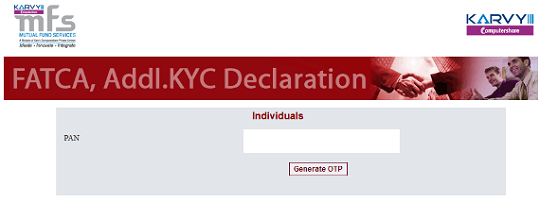

Filling FATCA Details Online at Karvy

If you have invested in mutual fund schemes serviced by Karvy , given below

AXIS Mutual Fund, Baroda Pioneer Mutual Fund,BOI AXA Mutual Fund,Canara Robeco Mutual Fund,Deutsche Mutual Fund,Edelweiss Mutual Fund,Goldman Sachs Mutual Fund,IDBI Mutual Fund,Indiabulls Mutual Fund,JM Financial Mutual Fund,LIC Nomura Mutual Fund,Mirae Asset Mutual Fund,Motilal Oswal Mutual Fund,Peerless Mutual Fund,DHFL Pramerica Mutual Fund,Principal Mutual Fund,Quantum Mutual Fund,Reliance Mutual Fund,Religare Invesco Mutual Fund,Sahara Mutual Fund,Taurus Mutual Fund,UTI Mutual Fund

- Visit Karvy website.

- Enter your PAN Number and click on Generate OTP.

Filling FATCA Details at Karvy

- Enter the OTP details and click on submit

- Submit the details as mentioned earlier

How to Update FATCA Declaration for Franklin Templeton Mutual Fund?

- Go through the following link for Franklin Templeton Mutual Fund FATCA Declaration.

- Enter your folio number and click on next.

- Enter you PAN Number and bank account details, pin code/Date of Birth/Last Transaction Amount and click on next.

- Post verification, you need to enter Gross annual income, Net worth details, Occupation & PEP Status and click on next.

- Verify the details entered and click on Submit to complete.

- You will get a transaction number for your reference.

Submit FATCA declaration form offline

- Submitting FATCA declaration to CAMSoffline : You can downloadCAMS FATCA Declaration form and submit the completed form at any CAMS customer service centres or post it to the address given below

M/s. Computer Age Management Services Pvt. Ltd.

Unit: Central Projects, Rayala Towers, 158 Anna Salai, Chennai – 600002

- Submitting FATCA declaration to Karvyoffline :You can downloadKarvyFATCA Declaration form and post the completed form to the address given below

Karvy Computershare Pvt. Ltd., Karvy Selenium Tower B, Unit – FATCA / CRS / UBO / Supplementary KYC,

Plot Nos. 31 & 32 | Financial District |Nanakramguda,

Serilingampally Mandal | Hyderabad – 500032 | India.

- Submitting FATCA declaration to Mutual Funds Offline

Download the FATCA form from mutual fund website likeFranklin Templeton website, HDFC website Fill the form and send it to address mentioned in form.

What do you think of frequent KYC by Mutual Funds? Have you done your FATCA declaration? How did you do your additional KYC?